Going to college can be expensive. Not everyone qualifies for federal grants, but 5.5 million students receive government loans each year.

The Federal government pays out these loans as part of a Federal Student Aid program under the U.S. Department of Education. However, students must meet certain requirements.

Students must maintain a 2.0 GPA and be enrolled in six hours. One thing the program does not take into account is credit, Erica Williams, SE financial aid director, said. Students with poor credit ratings are still eligible for this loan.

Two types of loans are available at TCC: the Federal Subsidized Loan and the Federal Unsubsidized Loan. The federal government pays the interest on the subsidized loan while the student is in school.

Currently, the unsubsidized loan requires the student to pay an interest rate of 6.8 percent, but the rate will drop to 3.4 percent throughout the next five years because of new legislation passed in the House Jan. 17.

To apply for a loan, students must start by completing the Free Application for Federal Student Aid. The FAFSA is usually done online and will be processed within seven business days. The student will finish required paperwork at the financial aid office.

Students do not have to repay the loans immediately. Payments are not required until six months after the student has either graduated or fallen below enrollment requirements.

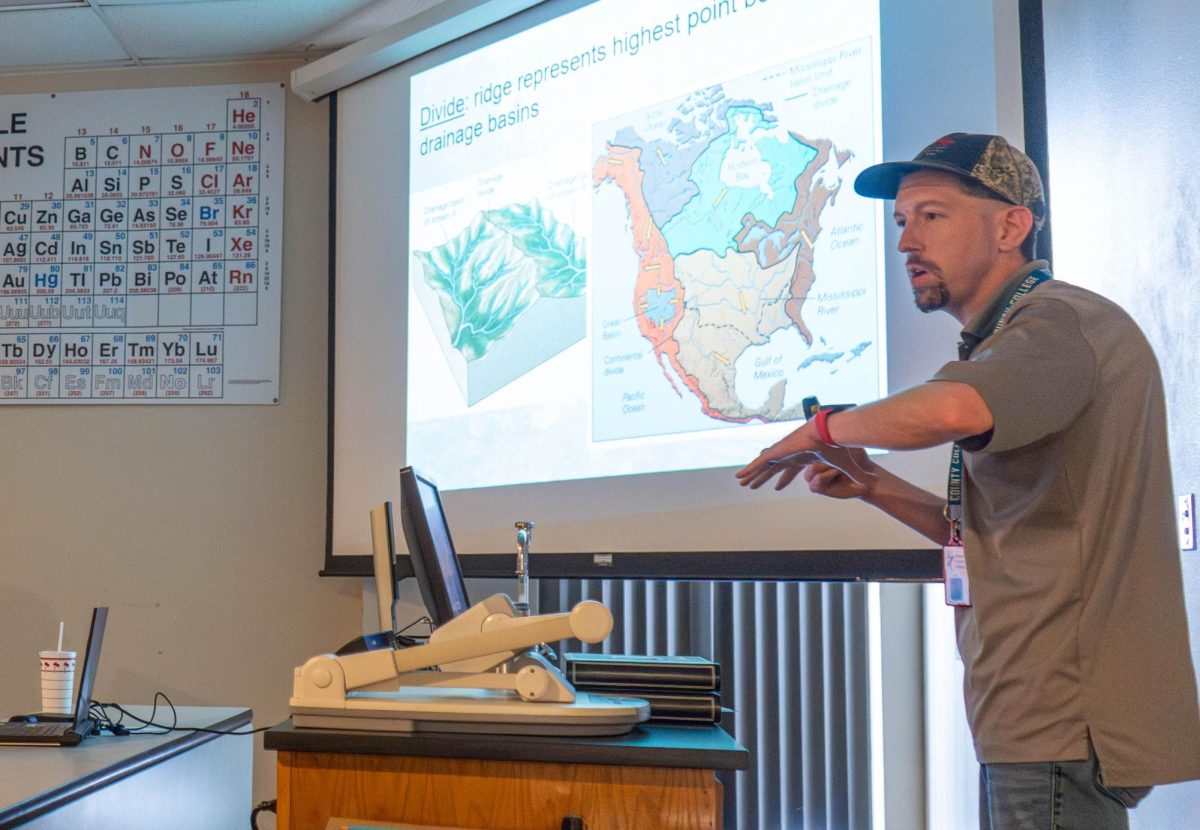

Williams, SE director of financial aid, said TCC students can get loan information from the TCC Web site or a campus presentation.

“There are many presentations on student loans throughout the year, and I hope [students] attend,” she said.