TCC has partnered with the Internal Revenue Service, the United Way of

Tarrant County and Catholic Charities Fort Worth to offer free tax preparation to all students and families with an annual income of $50,000 or less.

This preparation is a high-quality tax service being conducted by IRS-certified staff and volunteers on SE Campus in EMBC 1106/1107 4–8 p.m. Tuesdays and Thursdays, noon–4 p.m. Wednesdays and 9 a.m.–1 p.m. Saturdays through April 15.

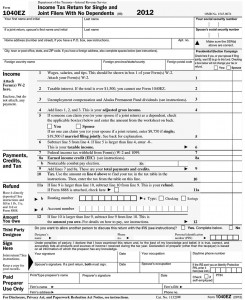

“Our services not only just prepare the students’ taxes for free, we help them understand what is being asked so the student can get more familiar with the terminology of tax returns,” said Michelle Bell, Catholic Charities site coordinator.

Bell said those seeking help need to bring an identification license, a Social Security card, Social Security numbers for any spouses or dependents being included in the tax return and the financial documentation for the return.

Mymy Tong, TCC student and tax preparation volunteer, said it’s in the students’ interest to get their taxes prepared for free. An additional benefit, she said, is a critique to see whether a student qualifies for other guide assistances.

“I love volunteering, especially doing something like this,” she said. “This has influenced me to pursue my future in tax preparation. Thanks to Professor [Karen] Haun [SE accounting assistant professor] for giving me the desire to become certified in tax preparation.”

Patricia Clough, SE English assistant professor, said the organizations producing these services are outstanding and offering them at TCC is a terrific idea. She hopes students take advantage of the free tax preparation so it can be offered at TCC again.

Bell said so far students have been taking advantage of these services, but she would like to see more students becoming aware of the opportunity to save some money. She said the lines haven’t been that long either.

“The longest wait I have seen so far has been about 30 minutes or so,” she said.