By Alice Hale/reporter

Having a savings and an emergency fund are well worth the sacrifices, an academic advisor told NE students earlier this month.

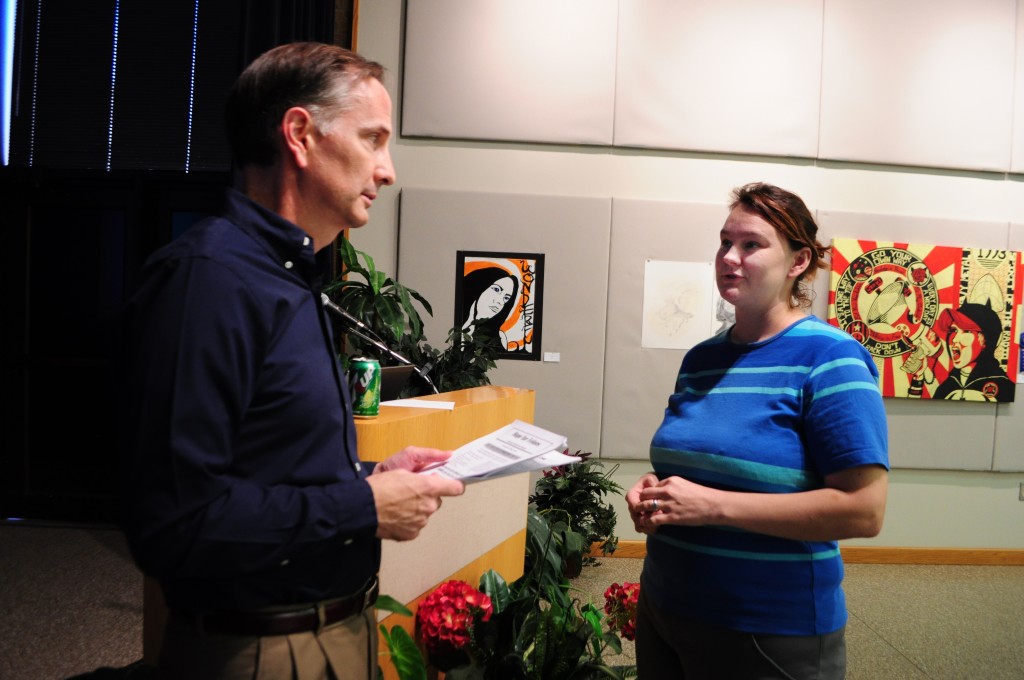

Randy Saleh spoke with students and gave advice on proper financial planning March 6.

Saleh demonstrated where most Americans go wrong when managing money and gave tips on how to get on track to being financially stable. Learning to save and sticking with it is one of the hardest, yet most beneficial things someone can do, Saleh said.

“This is not an easy process, and it will take a few months to make it a regular routine,” he said. “But it in the end, it can only benefit you.”

One major tip to get started Saleh gave was to use money instead of a debit card. Saleh also advised making separate envelopes and “give your money a name.” Then people should put the names on different envelopes to keep them from spending it elsewhere.

Using money allows people to “physically see and hold what it is you can spend and on what,” he said.

Saleh named one of the best things people can do for themselves.

“Become debt free and then stay debt free,” he said.

By learning to manage and pay off debt, people can focus their attention on more important things such as building a savings.

Saleh introduced what he refers to as the debt snowball. By listing debt in order from least amount to greatest, people should focus on paying off the smallest ones while maintaining payments at the minimum payment until the smaller debt is paid off, he said.

As one debt is paid in full, they can start applying that extra money they now have every month to the next smallest debt, bringing it up from the minimum payment they have been paying and helping pay it off faster. Once they have eliminated all their debt by continually applying extra money to the next debt up, they can start putting more money toward savings.

Student Joel Muesigwa, who moved to America a year ago from Uganda, said he found the presentation interesting.

“I grew up not using a credit card and paying for everything with cash, so you were not tempted to spend more than you have,” he said. “Here, the way the system is run, people run into debt easily.”

The U.S. used to be the largest creditor in the world, and now it is one of the largest debtors, Saleh said. While other world powers have high savings rates, he said the U.S. is the only one that has a negative rate.

One of the largest problems is that people are spending more money each month than they have coming in.

Saleh said if students learn to save their money, they can change these statistics, at least for themselves.

Some attendees, like student Ashley Roberts, have already started this process for themselves after taking courses taught by Saleh.

“I have been trying to buy a new house and have not been able to because my credit score was bad,” Roberts said. “After taking Saleh’s business course, I began to manage my money differently and have already seen improvement. I came to the presentation today to refresh myself on the material and to stay motivated.”