By Luke Newby/reporter

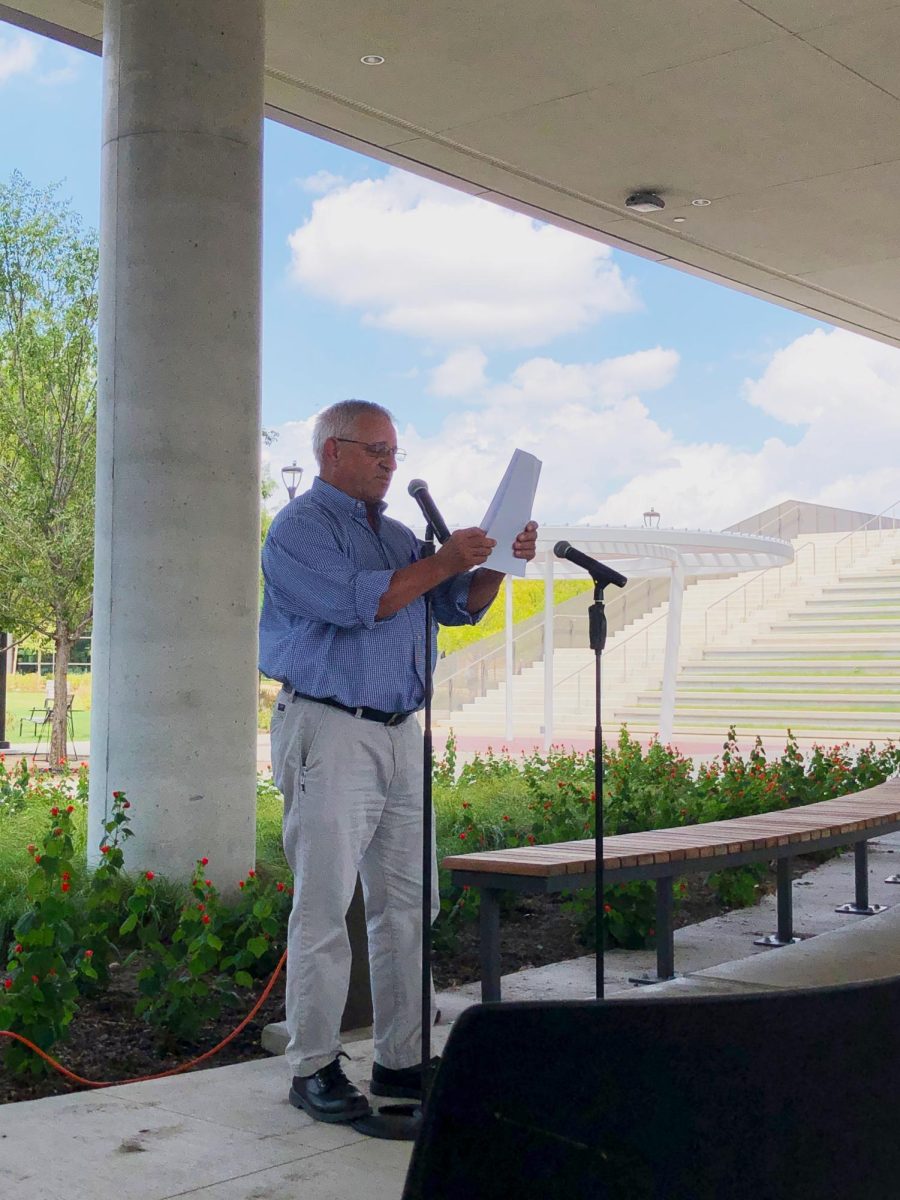

Students learned about the student loan borrowing process during a financial literacy seminar Feb. 19 on NE Campus.

NE financial aid specialist Joe Rodriguez shared tips on how students can invest carefully in their education when taking out student loans.

“The important thing is borrowing wisely, not for your wants but for your needs,” Rodriguez said.

He explained the difference between federal loan and private loan options for student borrowing. Federal loans offer flexible repayment options and grace periods and are generally cheaper with lower interest rates, he said.

Private loans are provided through a bank or credit union rather than the Department of Education. These loans are based on credit history and often require a co-signer.

Rodriguez said student loans are a relatively good form of debt.

“This is because you are investing in your future,” he said. “You are benefiting from a student loan.”

To help students keep up with their borrowing, Rodriguez told students to make student loan payments on time to build credit history and monitor their credit scores.

Students should not be afraid to discuss repayment options with lenders if they have difficulty making payments because a student loan default stays on credit reports for seven years. Students can track their federal student loan debt on the National Student Loan Data System at nslds.ed.gov.

Knowledge about student borrowing is paramount, Rodriguez said.

“Understanding this will help you understand and establish credit history,” he said. “As long as you stay active and start paying it back, it will help you purchase big items like a home and a car in the future.”