by Elaine Bonilla and Barde Eseyin

Students often think they don’t qualify for financial aid because they or their parents make too much, which is not the case, said NE financial aid specialist Danchees Ingram.

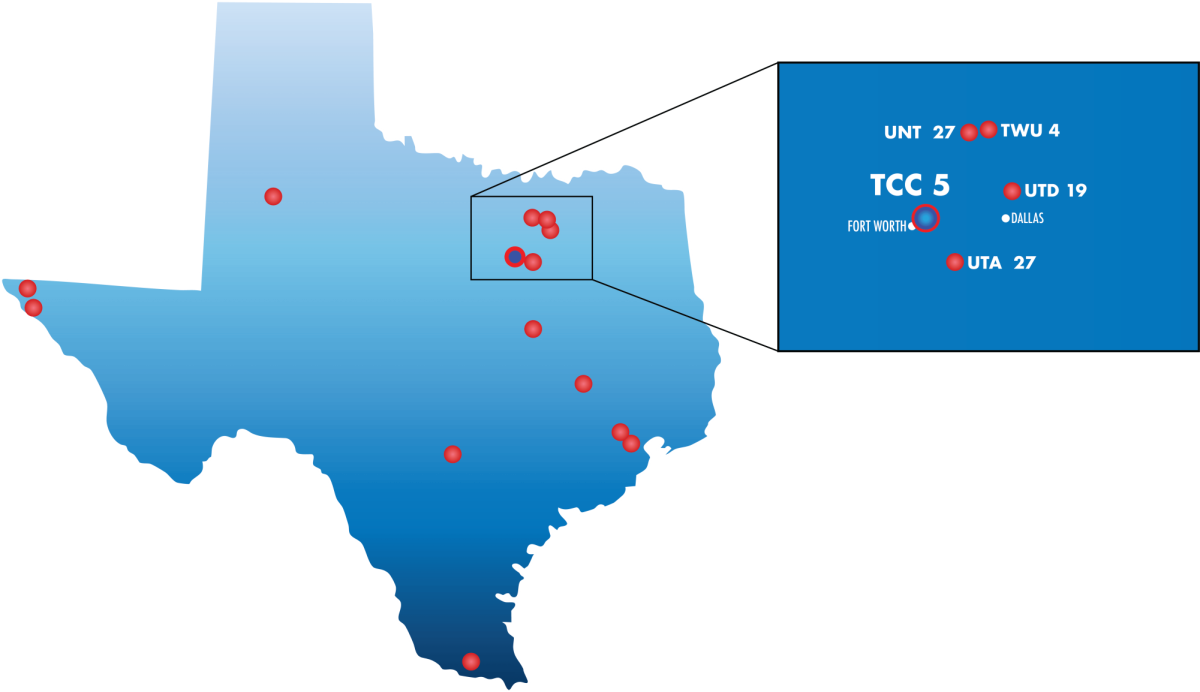

Financial aid is awarded in the forms of grants, work-study, scholarships and loans. The first step is filling out the Free Application for Federal Student Aid at fafsa.gov, and filling out one application is good for all TCC campuses and other institutions. Students can have their results automatically sent to TCC by using the school code: 003626.

The majority of TCC students who receive financial aid get grants from the federal government. Scholarships require additional research and work. Students can find out more information on www.tccd.edu/scholarships.

Students should submit their FAFSA by the priority deadlines to ensure funding. Deadlines are April 1 for summer, May 1 for fall and Oct. 1 for spring.

Ingram said many wait until the last minute to put their financial aid affairs in order. This delay causes a stressful cluster of students bombarding the school’s financial aid offices with phone calls and waiting in long lines to resolve something that appropriate timing can avoid.

“About 80 percent of students wait till the last minute to file for financial aid,” she said.

Delays in filing for financial aid have serious consequences, Ingram said.

“Students might have to pay out of pocket to stay enrolled in classes until their financial aid is approved,” she said.

If students’ financial aid is not approved by financial aid’s deadline, they are automatically dropped from their classes. They would have to pay the bill immediately to remain enrolled in the class.

This is not an option for every student because not everyone can afford to pay for classes out of pocket, which can hinder a student’s education at least for a semester.

“Students need to pay the bill that evening,” said TR financial aid director William McMullen. ”Otherwise, they need to start a payment plan through business services.”

South business services coordinator Tiffany Rodriguez said students can enroll in two different payment plans if they can’t pay all their tuition out of pocket at once: the undergrad pay plan or the pending financial aid pay plan.

The undergrad plan allows students to make two or three monthly payments with a down payment that varies from 10, 20, 25 or 50 percent, depending on when they sign up.

The pending financial aid plan offers two months of payments with no down payment.

“The student needs to talk to financial aid and let them know if they can’t pay out of pocket,” Rodriguez said. “Financial aid then flags the account, and students can go online to create the payment plan.”

Once financial aid documents have been submitted, students can set up their plan.

Students would then go to Payment Options on WebAdvisor to choose the appropriate option and set up a plan.

“Another con that is caused by late financial aid applications is losing eligibility — no funding,” Ingram said.

The federal government provides only a certain amount of funding for college students and prospects, and it is distributed on a first-come, first-served basis, Ingram said.

“Students who wait till the last minute to take care of their financial aid responsibilities have a higher chance of not finding seats in their intended courses,” she said.

This can leave the student with an unproductive semester or force them to take courses not on their degree plans. The most important thing to remember, Ingram said, is to apply early and apply every year.

“Apply two to three months prior to the semester you wish to be enrolled in school,” she said. Early applications provide “full eligibility. Students will be eligible for anything the government and institutions offer.”

Another resource to ensure successful enrollment is the “7 Easy Steps to FAFSA” video on the FAFSA website. It explains the required PIN number and other information students may need to complete the form completely and successfully.