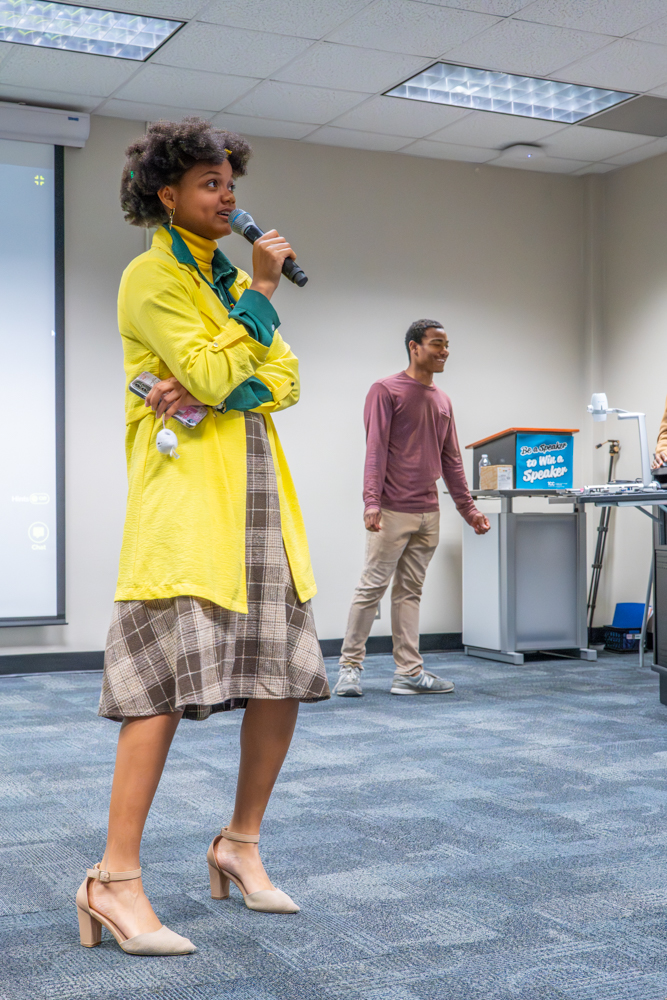

By Josh West/reporter

Business assistant professor Randy Saleh presented a seminar Feb. 10 on NE Campus about establishing a good credit score and eliminating some debt out of one’s life.

“It’s becoming a national problem,” he said.

Saleh said the student debt has become a national issue for the first time in history. In 2003, student debt totaled $300 billion.

“How much student debt is in America? It will be $1.4 trillion by the end of the year,” he said.

The average American family will have a sum of $1,500 dollars in the bank while the average Japanese family will have $20,000 or more in the bank, Saleh said. Seventy percent of Americans are one month away from a financial disaster.

”Seventy percent of Americans spend less than 20 minutes per month on their personal finance,” he said.

In the 1970s and 1980s, the establishment of credit became a phenomena that gave people the ability to pay with credit cards instead of cash, Saleh said.

“Credit scores range from a 300 to a perfect score of 850, but most Americans are at just a fair score of a 678,” he said.

Interest rates go up every year raising initial debt, especially when credit scores are low.

![Untitled [House], Barry Anderson](https://collegian.tccd.edu/wp-content/uploads/2016/02/House-640x480.jpg)