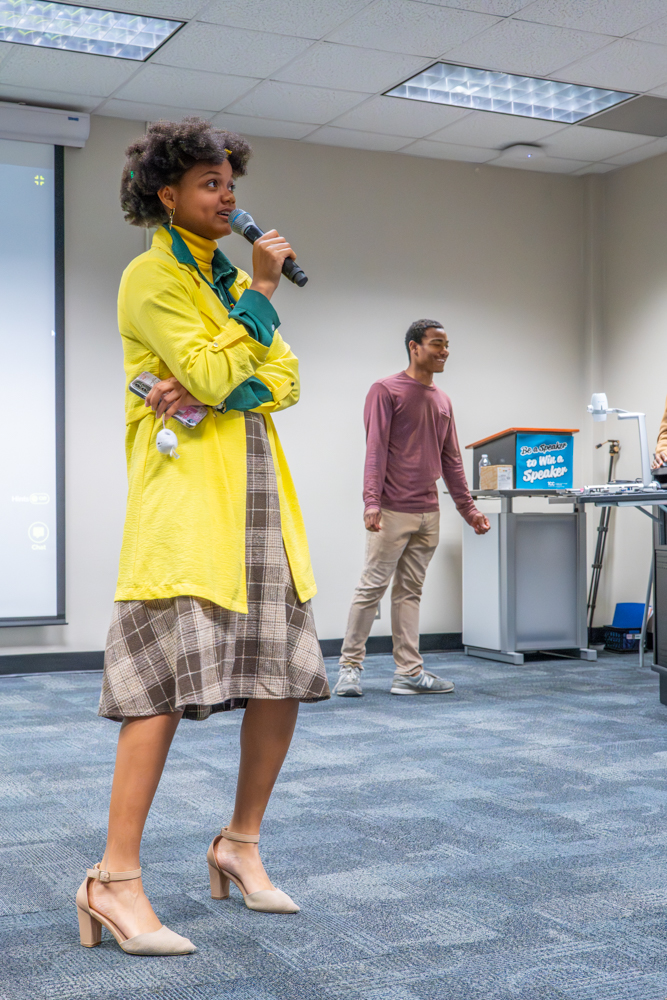

By Cale Sherrod/ reporter

Even with all of the money he saved by going to TCC, one NE student says it is still a challenge for him to save money and budget properly.

“I can’t really afford to save,” NE student Montana Montez said. “Between rent, food, school, and everything else, there isn’t much left for me to save,”

In her 33 years of banking, Fort Worth Community Credit Union head teller Elizabeth McLeod said she has seen students suffer from mismanagement of credit, overdrawing their accounts and lack of budgeting.

“College students struggle with spending money they don’t have,” she said.

One solution to this common mistake made by college students is to keep a check register, McLeod said.

“I know many college students today don’t even know what a check register is, but they can really help people see how much they are really spending versus how much they make every paycheck,” McLeod said.

To help build credit, she recommends keeping a journal to record all credit card purchases. At the end of each week, students should pay off the credit card in full and repeat the process, making sure not to leave any balance unpaid.

Students should set aside a small part of each paycheck that they allow themselves to spend each week, she said.

What the student chooses to do with that money is up to them, but if they save it for later, they will have more money to spend on themselves next week.

“It really helps me appreciate my money,” McLeod said.

McLeod recommends finding a secure financial institution that offers free checking and savings accounts and charges minimal fees, especially for people just starting to save.

But students have also come up with other ways to prepare for the future.

“I always send 20% of my paycheck to my savings account via direct deposit,” NE student Courtney McDonald said. “No matter how much I spend, I can always count on having some money saved up for later.”

“I invest some of the money I earn in stocks and keep my spending money in my sock drawer,” NE student Evan Weems said.

Weems said he also holds a checking account and follows a monthly budget.

“I have a Bank of America savings account I pretend I don’t know about,” NE student Karen Ortega said.

Every paycheck, Ortega deposits cash into her savings account and refuses to touch it until her next payday.

“I know I’d spend it all if I let myself, so I just don’t,” Ortega said.

Ultimately, McLeod said it is important for each student to find the financial habits that work for them.

Budgeting and using resources from local financial institutions help college students manage their money can more effectively.