By Maria Asprilla/reporter

College students need a plan to keep their spending in check, a NE Campus financial aid specialist said recently.

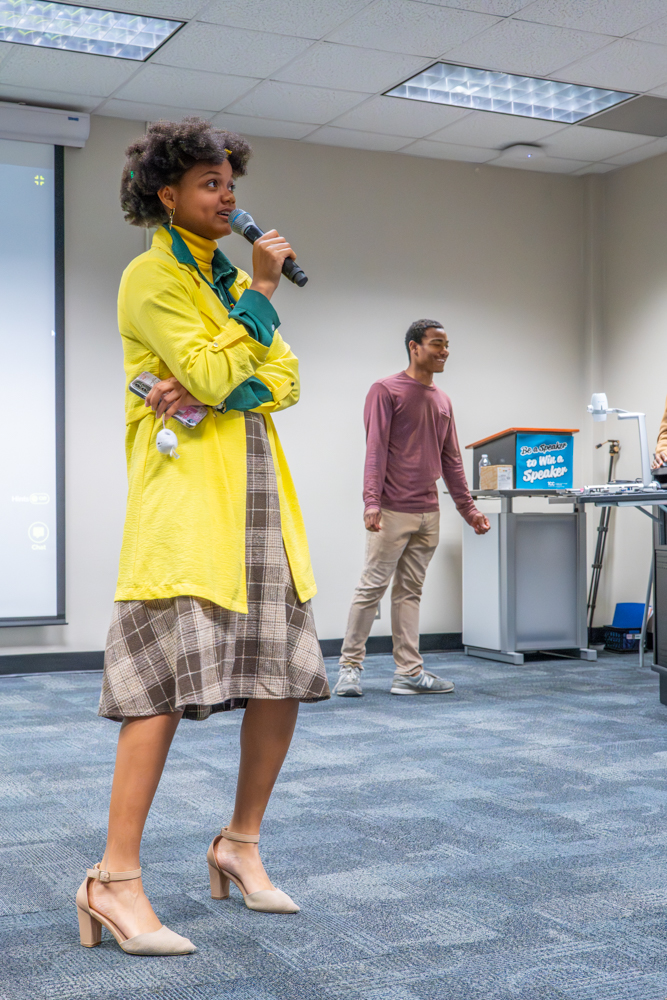

Danchees Ingram presented Spending Plans: Meeting Goals the Simple Way Oct. 13, concentrating on strategic thinking as it relates to income and spending to help students understand how to make ends meet. Ingram compared not having a spending plan to taking a road trip without a plan. The traveler may stumble upon interesting people and places or run out of gas and money.

“You take your chances when you don’t plan ahead,” she said.

A good spending plan will satisfy needs, help avoid debt, match income and investments, avoid management fees from banks and help people reach life goals, Ingram said.

“Knowing your resources is the basis of a good plan,” she said.

Two keys are income and expenses. Making a list of all expenses, either over a month or over a year, is the first step and is a learning process that involves some common mistakes, Ingram said.

Mistakes include not planning for irregular expenses such as going to the emergency room or needing new tires. Some people tend to squeeze the spending plan, not allowing wiggle room in life. Others don’t account for what Ingram calls “mad money,” which is for treats and impulse purchases like a Starbucks coffee or a new pair of shoes.

Failure to save is also a common mistake corrected by having money automatically drafted from a paycheck, Ingram said.

Students can do a variety of other things to help their budgets. A cash flow statement should be put together to see when income comes in and when bills are due, Ingram said. For example, the rent due at the beginning of the month should be paid with the first paycheck, and the car payment due later in the month should be paid with the second paycheck. This helps avoid overdraft fees, which can be costly.

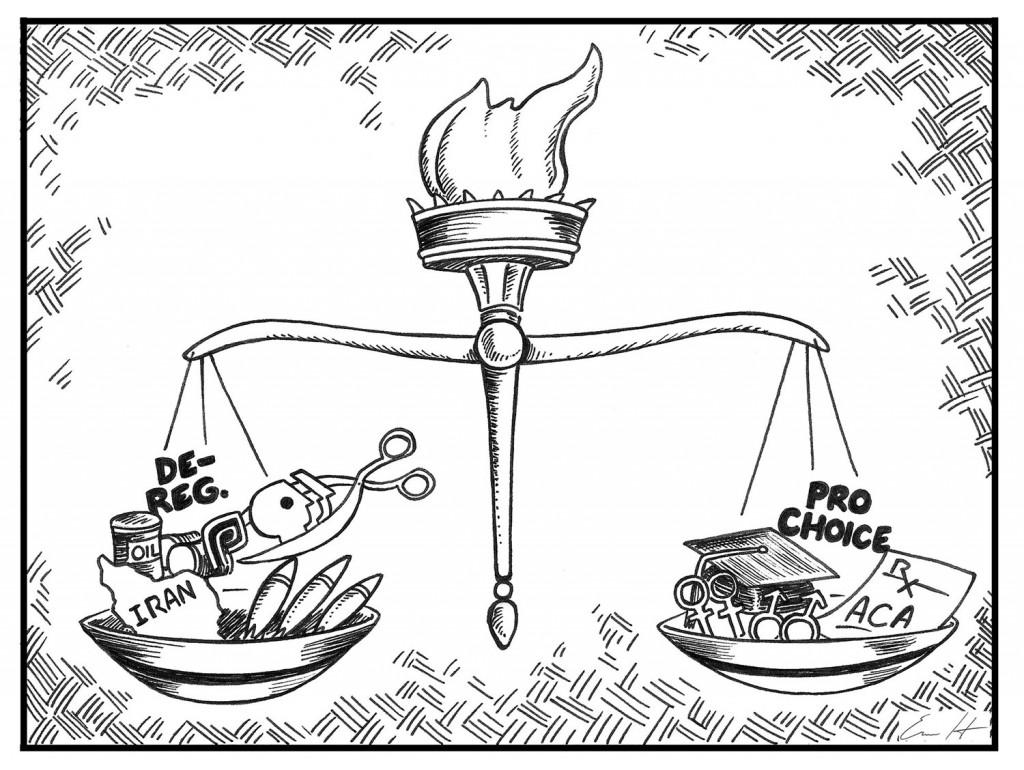

If income is less than calculated expenses, then it is time to increase income or cut expenses, Ingram said.

“Evaluate your needs versus your wants,” she said. “Be honest with yourself.”

Ingram recommends a “step-down spending method,” which involves looking for cheaper alternatives. Ingram expanded on this concept with a sort-of board game.

For the game, audience members paired off and were given a budget of 10-25 chips. Using these chips, the teams had to decide on levels of housing, transportation, clothing, medical care, savings, food, phone service, Internet service and entertainment. Just when the teams thought their budgets were complete, Ingram took away five chips.

“Life happens,” she said. “You have to make those choices sometimes when your expenses change.”