By Joshua Knopp • special assignments editor

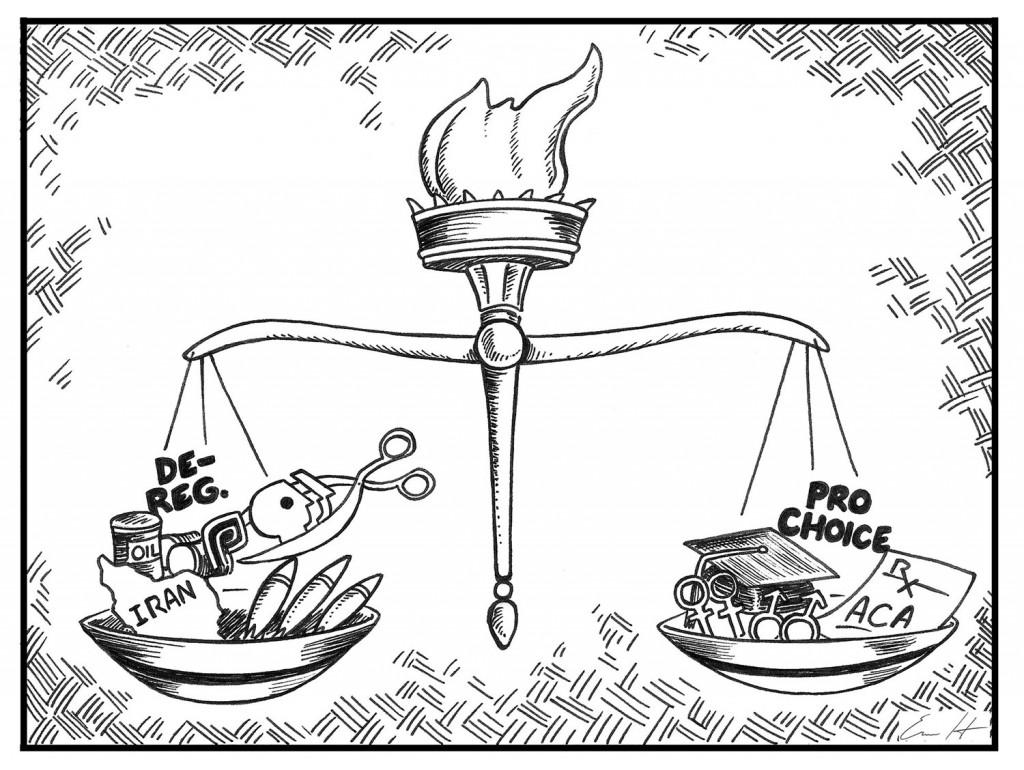

His tax plan is to close corporate tax loopholes and allow the Bush-era tax cuts on households making more than $250,000 per year to expire. Households making less than that will not see a tax increase. It is important to note, however, that if a disagreement over the top end tax cuts extends to Jan. 1, all the tax cuts will expire, and everyone’s taxes will increase. Another important note is the taxes on corporations that Obama’s plan includes would be strong enough to hurt stockholders, according to the Tax Policy Center. This part of the plan would affect 27 percent of households.

Student loans, college costs

Running mate Paul Ryan mentioned a need for lower college tuition rates, and his proposed budget would cut federal student aid.

Obama

He introduced a “pay-as-you-earn” plan that would cap the amount collected for student debt at 10 percent of monthly discretionary income, down from 15 percent, and forgives outstanding debt after 20 years of payments, down from 25. In January, Obama began threatening to pull federal funding from universities proportional to the tuition they charge.

Obama put pressure on Congress earlier this year to extend the current student loan interest rate — 3.4 percent — for another year when it was set to double in July. Congress will face the same decision next year.

Health care

The health care plan Romney instituted as Massachusetts governor helped to inspire ObamaCare. The law also included a mandate that an individual be covered, an allowance for young adults on their parents’ plans and regulations on the insurance market.

The differences, according to politifact.com, largely lie in how the laws are paid for — ObamaCare raises taxes while RomneyCare leans on federal funding — and the degree to which they regulate the markets. RomneyCare doesn’t regulate insurance costs as much as ObamaCare.

Obama

He supported the passage of the Patient Protection and Affordable Care Act, better known as ObamaCare, in 2010.

The law allows dependents to remain on their parents’ insurance plans until age 26, bans insurance companies from rejecting customers over pre-existing conditions and mandates that plans cover many preventative services without a co-pay. Required services include mammograms, colonoscopies, sexually transmitted infection counseling and contraception (some religious groups were given a waiver on contraception, but that waiver expired in August).

The law includes a mandate that insurers spend 80 to 85 percent of their dollars on health costs or send the rest back to policyholders. Starting in 2014, citizens who aren’t covered under an approved health care plan (with exceptions for those whose religions forbid it) must pay a penalty. Starting in 2017, states can apply for immunity to this clause.