By Angela Brown/ reporter

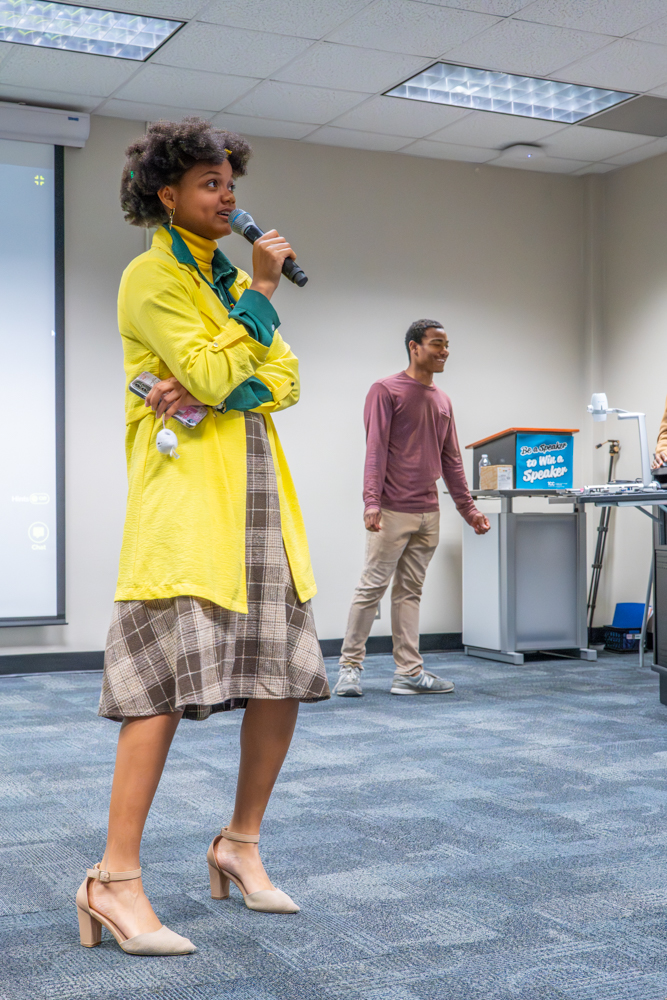

Bogdan Sierra Miranda/The Collegian

Student loans are a great way to begin managing one’s credit, a SE success coach said April 25.

Edward Hicks conducted the Money Mondays: Managing Credit session informing students of the importance of knowing one’s credit score and maintaining a good credit history, which has a lifetime effect.

Managing spending gives students a greater access to credit and will determine the loan amount they receive and the rate of interest they pay back to creditors.

“The price that one pays for credit is called interest, which is the cost of using credit,” he said. “A good credit score means you pay less interest for loans.”

Hicks said 35 percent of a credit score is based off of repayment history. It is important to never have more credit than needed and to always pay bills on time. Though some payment history may not be reported to a bureau, how one repays others, such as a friend or a family member, still reflects payment habits whether good or bad.

Thirty percent of one’s annual income should be used to pay non-mortgage debts, Hicks said. Companies such as the utility company and the phone company will only report information to credit bureaus if it’s negative. This information is combined into one report and is provided to lenders one may want to borrow from.

Many employers will check a potential employee’s credit score to determine if that person uses good judgment when it comes to spending, Hicks said. This information could be the determining factor if a person is hired or not.

“Setting priorities and avoiding pitfalls regarding credit is a key factor,” he said. “Two elements that make up your credit reputation and trustworthiness as opposed to your credit worthiness are your credit report and your credit score.”

Hicks said negative information stays on a credit report seven years, and bankruptcy information stays from seven to 10 years.

Lenders use credit scores to verify if a person is a “lending risk,” less likely to pay back debts, Hicks said. A good credit report will determine not only one’s buying power for now but also for the future. Credit reports give an analysis of loan history, repayments, outstanding balances, types of loans and frequency of requests for a new credit line.

It is possible to change the negative history of one’s credit, Hicks said. But it may take up to one year to see results.

“Knowing how the score is determined gives you the knowledge of how to improve it,” he said.

It is important to keep even old credit cards open because canceling a credit card will actually lower a credit score, Hicks said. The length of time one has credit is also a determining factor in a credit score, so closing accounts could be harmful.

Hicks suggested using a credit card at least one time every three months to keep the accounts open. He also said everyone should pay the balance due before the due date to avoid interest charges.

“An example in the difference you pay could be in the purchase of a $29,000 vehicle with a 5 percent interest rate versus a 12 percent rate,” he said.

That results in a $5,800 savings over the lifetime of the loan.

“You may forget about your old mistakes, but your old mistakes are slow to forget about you,” he said.

Free yearly credit reports are available from three bureaus: Transunion, Experian and Equifax. Hicks suggested requesting them one at a time every four months.