By Luke Newby/reporter

Students were equipped to deal with real-world situations during a financial information session at NE Campus Feb. 5.

NE financial aid specialist Joe Rodriguez taught students to recognize the need for tracking spending and credit reports.

“These things are not taught in high school but are very important to know,” he said.

For students, financial aid and student loan scams are common, he said.

Rodriguez added that repayment scams that offer loan consolidation or FAFSA help for a small cost pose a threat to uneducated students.

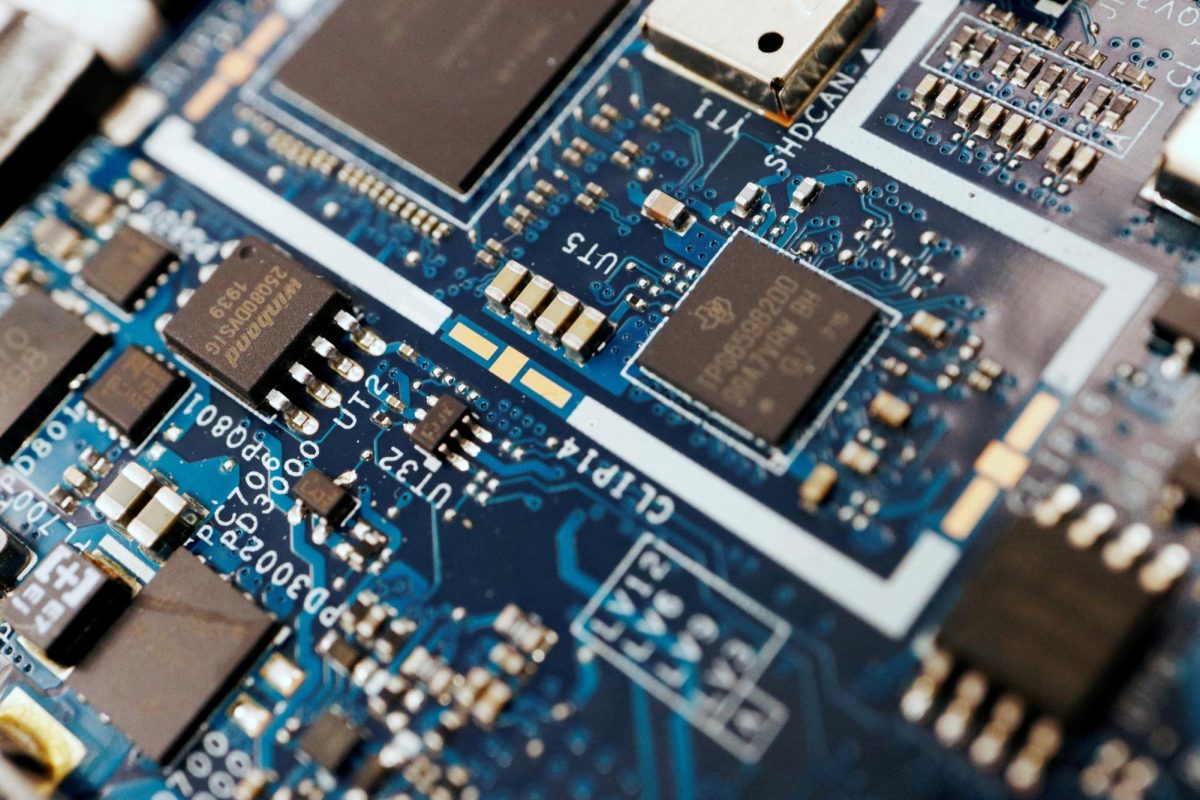

In today’s digital age, things like email phishing, credit card skimmers, phone scams and identity theft are all dangers students must be aware of, Rodriguez said.

Websites like nslds.ed.gov provide information about all forms of financial aid students have used in the past.

Rodriguez told students about his experience as the victim of a credit card scam.

“If it wasn’t for be being on top of it and checking my bank records, I would have never saw it,” he said.

Companies like Experian, Equifax and Transunion offer a free credit report once a year, which can help students stay informed about credit history and activity.

Rodriguez described credit reports and the best ways to monitor them to students.

“Your credit report is a record of your borrowing and repayment history — a report card for your financial life,” he said. “I recommend checking your credit from a different company every four months, so you can monitor your credit for the entire year. Checking your credit report can help you spot any errors made by other companies.”

Rodriguez offered suggestions to students if they become victims of credit fraud including asking credit agencies for copies of reports and filing a report with the Federal Trade Commission and local law enforcement. He advised students to monitor their accounts to make sure illegal charges are removed and asking for credit freezes.

Students can also visit www.identitytheft.gov for help in putting together a recovery plan.