By Patrick Cusack/reporter

Most students would not expect to be in the middle of a national identity theft ring, but it has already happened on many college campuses around America, including the Tarrant County College District.

AWARENESS

Susan Freeman, a third-year student on NE Campus, has struggled with identity theft.

“ It must have taken me three months to completely sort out that mess,” she said. “When it was finished, I had lost $1,300 and had to take a second job to continue attending school.”

Donald Wright, a former South Campus student, had his wallet stolen from his locker in the gym while he was playing basketball. Three months later his credit card had been maxed out and bogus checks had been cashed on his account.

“I was not sure I was ever going to get things straightened out,” he said. I kept getting calls from people asking me if I was ready to settle on an account I had opened or to pay for items I had bought on a new credit card that had been issued in my name at Home Depot.”

Wright eventually managed to clear his name and his credit, but he ended up having to start all over again with building a clean credit record.

“Basically, since identity theft has gotten so bad, companies are beginning to cut us victims some slack, but you have to be able to keep your cool as you try to rebuild your identity,” he said.

Freeman’s and Wright’s cases are more than the average student theft.

“Many cases involve no more than $500 with most students receiving all of their money back within a year,” Albert Hung, a Washington Mutual financial adviser, said.

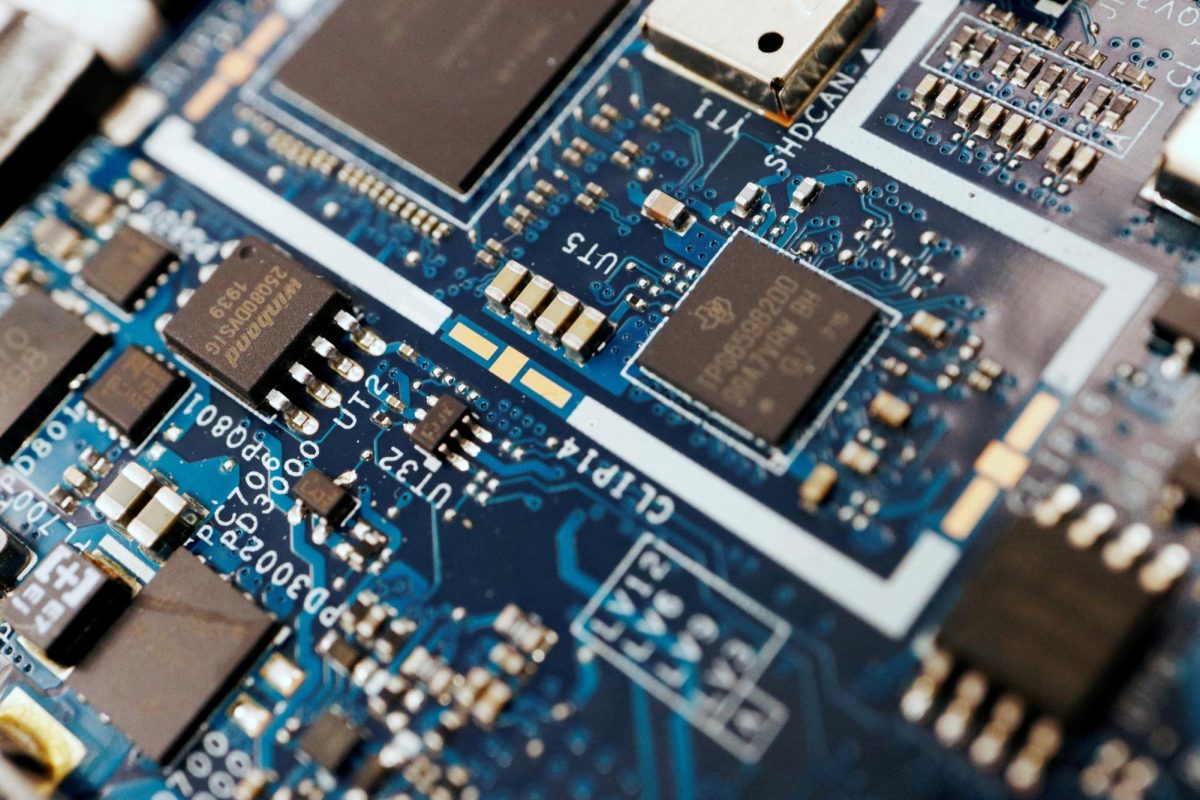

ID theft can happen many ways, but the Federal Trade Commission reports two of the most common among college students are phishing and improper handling of their personal information.

With the growth in Internet use, phishing has become popular. By setting up fraudulent sites that resemble legitimate sites and sending an e-mail leading that user into the fake site, the thief can sit back as the user types in his personal information.

According to the FTC, “Improper handling of personal information has two main sources of privacy compromise: first party and third party.”

First party is at the fault of the victim. The compromise takes place when the victim leaves any form of private information accessible to the public: bank checks, Social Security cards, debit or credit cards, driver’s license or pin numbers.

“Many times a victim will be at an ATM and the thief could be watching them enter their pin number over their shoulder or even through a remote camera installed on the ATM itself,” Hung said. “These thieves are crafty and are only getting better at what they do, which is waiting for someone to be caught unaware.”

Hung said October through December are the busiest months for identity theft.

“The holidays present a time of vulnerability among students caught up in the confusion of the holiday season and are more likely to let their guard down,” he said.

Third-party theft can occur when an organization or company sells, leases or gives personal information to another company. For instance, an online shopping site or credit reporting bureau can release information received legitimately to a supposedly legitimate company that, in turn, uses it to steal the person’s identity.

“Most consumers are unaware that companies are actually allowed to give, lease or sell personal information of consumers,” Hung said. “It all depends on the privacy policy of the Web site or organization.”

PREVENTION

According to the FTC , identity theft can cause a lot of damage both in money and time, but taking some time to prevent ID theft can prevent grief in the future.

“Most students are not educated as to what it takes to protect themselves from identity theft,” the FTC reports.

Hung said cautious consumers can stop dishonest people in their tracks.

“Watch your back. Cover your hand at ATMs and scratch out information like name, authorization number and reference number on the return receipts at restaurants when using cards,” he said.

When browsing the Internet, people should watch the address bar for suspect Web site addresses that differ from the normal Web address. And looking for https:// instead of http:// when shopping or being asked for personal information online can prevent information theft.

The FTC also recommends reading each individual privacy policy on Web sites that ask for personal information. The time it takes to read can make all the difference in preventing identity theft.

FTC PROTECTION TIPS

The FTC created a five-step process for students or other consumers to better protect themselves.

Take Stock. Arm yourself by knowing what personal information you have in your files and on your computer or even what is on your person and in your vehicle.

Scale Down. Keep only what you need for your personal business.

Lock It. Protect what information you decide to keep. Don’t leave stubs or other vital information lying about.

Pitch It. Properly dispose of what you no longer need. Using a crosscut micro confetti shredder is a very secure disposal route.

Plan Ahead. Create a plan to respond to security incidents. Contacting a financial adviser at your bank is one of the best places to start gathering information for your plan.

Source: www.ftc.gov.