Biden announced on Oct.4 that his administration has recently approved $9 billion in student loan forgiveness. While his administration faces opposition from conservatives and those who feel student debt forgiveness is unfair, the pursuit of debt relief continues on.

Keeping up with changes being made regarding debt relief plans is important for students currently pursuing higher education and those interested in continuing their educational journey.

Many students are considering where they will attend college or university their senior year of high school. Being knowledgeable about the negative impact of student loan debt in America is imperative.

Knowing what resources are available can have a significant impact on decision making when it comes to where someone chooses to attend school and what aid they’re interested in applying for.

Making financial choices that best suit one’s situation can play a big role in their overall experience of higher education. According to Education Data, 46.3 million borrowers have federal student loan debt.

On June 30, Biden’s initial plan to forgive up to $20,000 in student loans was struck down by the Supreme Court. There is currently a new forgiveness plan, the SAVE program, that is an income driven repayment program.

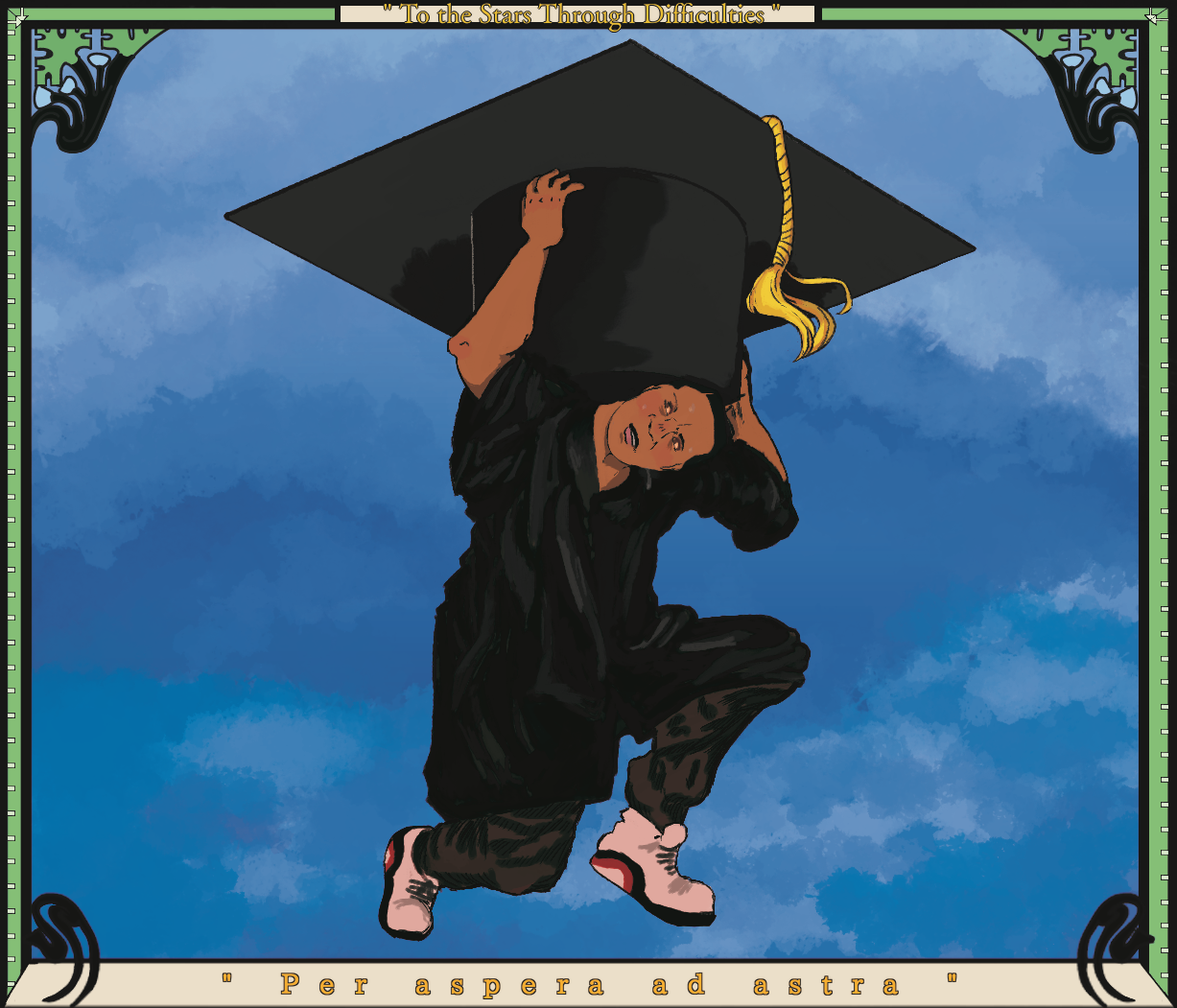

For many Americans, the cost of colleges and universities place many in a position where pursuing education after high school may feel sacrificial. There shouldn’t be a “choice” of college or debt. Student loan debt has a big impact on people’s lives. There are already many financial obligations many already have. The added stressor of having to not only pay off one’s initial tuition but interest, burdens a large part of our population. The federal government and private institutions shouldn’t be profiting off of educating the public. A lot of career paths require a degree, yet getting a degree for many isn’t a feasible option.

Incentivizing those to continue learning should be the goal. Considering the current cost of living, the stress of unpaid student loan debt can be overwhelming. The efforts being made by the Biden administration give Americans buried under debt the opportunity to breathe.

While some argue that people should be held accountable for their own economic decisions, in regards to student loan debt, it’s important to consider generational wealth, as well as people’s socio economic make-up.

In response to Biden’s announcement of $9 billion in debt relief, Republicans have criticized Biden’s policies by saying that the money is “wasteful spending” and have questioned whether or not he’s exceeded his authority.

With the crisis of student loan debt only continuing to accumulate, debt relief is bringing aid to those who’ve carried the weight long after earning their degree. It’s a plan to help many people who can’t just “pull themselves up by their bootstraps”. Just because the taxes people pay don’t go directly back into their pockets doesn’t mean it’s wasted or unfair. This isn’t Survivor where the focus is survival of the fittest. Supporting those who need relief is called for.