By Cory Armstrong/reporter

One cannot find a better time to invest than now, a certified financial planner told South Campus students last week.

John Loyd quoted Thomas Jefferson to explain the best time to invest.

“The best time to plant an oak tree was 20 years ago,” he said. “The second best time is now.”

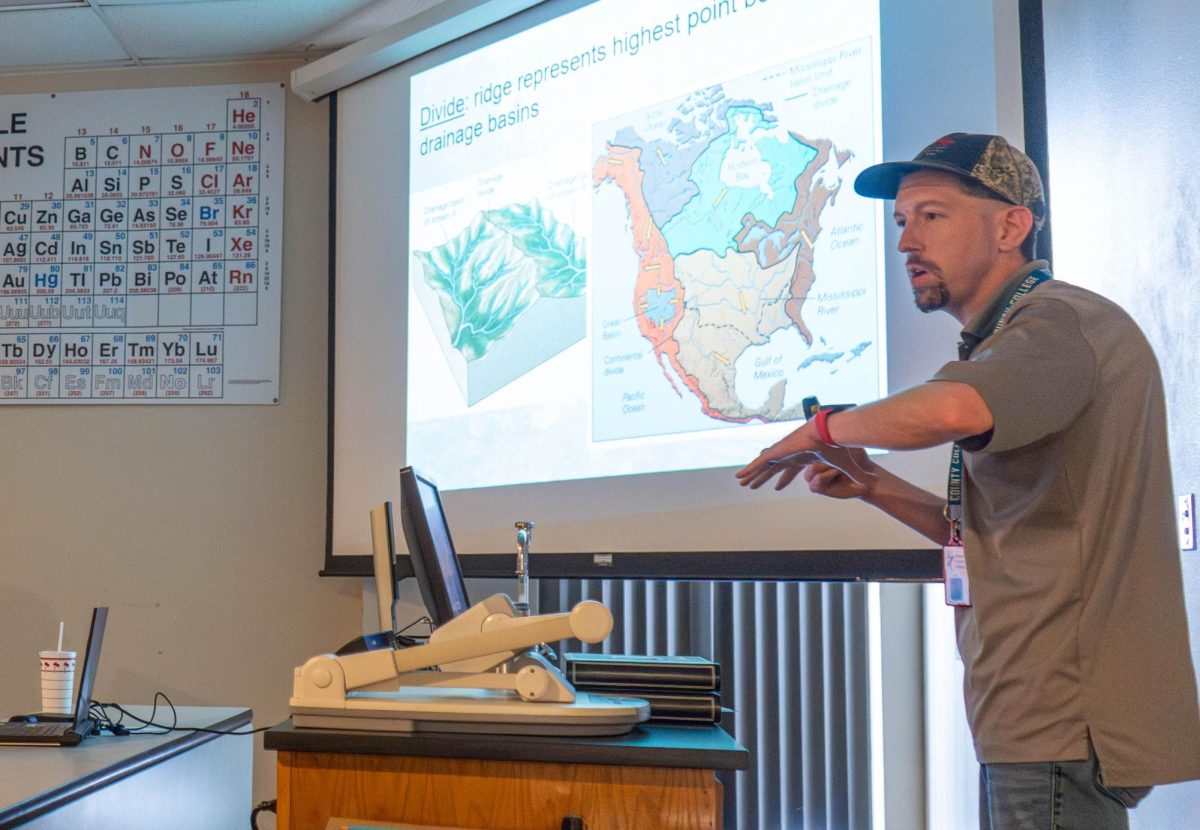

Loyd spoke to a class of 23 Feb. 5 about the importance of investing and the monetary benefits in Money Management Made Easy.

Loyd, a Southwest Texas graduate, currently serves on the Board of Directors of the Dallas/Fort Worth Financial Planning Association. He is also lead instructor for the University of Texas at Arlington’s CFP certification program.

Holding up his INVEST license plate, Loyd explained the common response to his plates. The first question asked is always “What is the best investment to make?”

“The best investment you can make is in yourself,” he said.

Self-control is important, Loyd said. Many people spend more than they earn. Loyd said for nine out of 10 people, this is not a math problem, but a behavior problem. He also said it is not about what one makes but what one keeps.

The first step, Loyd said, is to set goals. People should write them down and post them everywhere.

“If there is one thing you take out of this presentation, take this: set goals,” he said.

Loyd offered some simple ways to free up cash. His list included using only a cell phone, getting a less expensive haircut, splitting meals with boyfriend/girlfriend, quitting smoking or drinking and getting rid of cable.

“Your $500 car does not need $2,000 rims,” he said.

Loyd said students save quite a bit by forgoing cable. For instance, if a college student were to save $50 a month instead of getting cable, with a 10 percent return he/she could earn more than $500,000 by the age of 65.

People are living longer and longer and can spend more time in retirement than they do in the workforce. Therefore, saving for retirement is very important, he said.

Although not FDIC insured, mutual funds are the best way to invest money, Loyd said. Mutual funds over 10 years have a positive return 99 percent of the time and have a higher interest rate.

Three simple tips for investment, Loyd said, are to buy low and sell high, diversify and have patience. Some common mistakes to avoid are having incorrect beneficiaries, not having a valid or updated will and not protecting assets.

Loyd said the best investment plan for a college student putting away only $20 a month is “a Roth IRA.”

“If you think you can or you think you can’t, you’re probably right,” he said quoting Henry Ford.

For more information on investing, visit Loyd’s Web site at www.thewealthplanner.com.