By Karen Gavis / editor in-chief

By Karen Gavis / editor in-chief

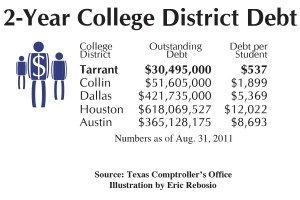

TCC is on track to be where only three Texas colleges are now— free from debt.

The college could have a zero balance as early as 2015, largely because of its pay-as-you-go policy.

“We not only have been able to pay cash for projects and programs but are paying down our debt and will be one of — if not the only — college/university in the country which is debt-free,” board member Louise Appleman said.

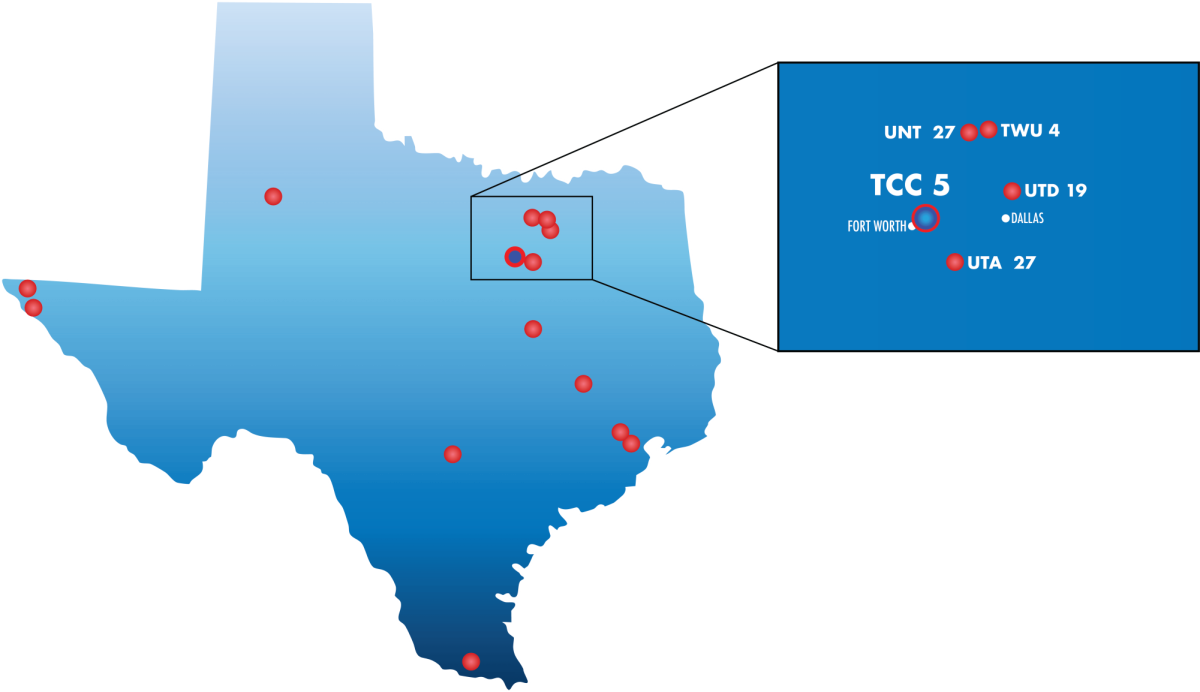

According to a report released by Texas comptroller Susan Combs, TCC is ranked among the fastest-growing Texas community colleges. While the college’s enrollment has nearly doubled over the past decade, its outstanding debt has decreased 66 percent since 2001.

In 2008, while under the leadership of former Chancellor Leonardo de la Garza, the college’s board of trustees unanimously approved a pay-as-you-go policy. Appleman said board members adopted the philosophy because they believed it would save the college as well as taxpayers money.

“Using funds from bonds and other borrowed money is like using a credit card,” she said. “When you make payments, it is usually a great deal of money toward interest, prolonging the relief of debt.”

De la Garza, along with Lily Tercero, wrote in Diverse Issues in Higher Education that before implementing pay-as-you-go, “the college had accumulated the highest tax-supported bonded indebtedness of the 50 Texas public community college districts.” De la Garza also said the college’s tax rate was the state’s lowest.

Board member O.K. Carter said although he was not a board member when decisions were made to raise taxes and convert the college to a pay-as-you-go institution, he could offer insight about the plan’s advantages and disadvantages.

A few advantages, Carter said, are that money saved by avoiding interest payments can be used for other purposes. Lengthy and costly bond vote campaigns can also be avoided as well as voter mood swings. Planning becomes a smoother process.

However, a disadvantage for citizens is that they have virtually no say in decision-making processes regarding capital projects, Carter said.

“Not exactly a resounding endorsement for what is supposed to be democratic government,” he said. “Over time, the temptation to use excess funds for operational costs (salaries, benefits, basic maintenance) instead of capital projects (new labs, classrooms, infrastructure) tends to be irresistible and over time, the excess disappears, which is what is happening now.”

Another disadvantage, Carter said, is that minus the discipline of seeking public approval, project costs can spiral.

“The best recent illustration being the half-billion dollars invested in the [TR, TRE] river campuses,” he said.

The investments were dubbed by some as a costly boondoggle.

Nonetheless, according to a recent financial report, the college’s final bond payment is scheduled for 2015.

However, another potential hefty outlay with construction firm BOKA Powell is in the works. The plan aims to comfortably accommodate a projected 115,000 students by 2020 and would, among other things, add 100-seat learning areas on each campus. Although, whether partially or completely implemented, the proposed $375 million plan would not necessarily sound a death rattle for “pay-as-you-go,” Appleman said.

“While the BOKA Powell recommendations are ambitious and of great interest to the board as we seek to improve the learning environment for our students, they have not yet been approved,” she said. “We have already begun to initiate some of the programs — Innovation Forum, math emporium, sticky spaces — as they fit within the existing budget.”