A college degree is now required, or at least a huge plus, when looking for a job. College is expensive. Debt is something most students would like to avoid.

But those three facts don’t mix well in today’s world. Americans’ total student loan debt is now greater than their total credit card debt. In September 2010, the U.S. population owed more than $850 billion in student debt but $828 billion in revolving credit, including credit card debt, according to USA Today.

This has made some colleges reconsider providing loans to students already deeply in debt. Florida State College at Jacksonville has already “requested the power to deny students federal loans if they have too much debt,” according to news4jax.com.

“This would be an extreme case, students who’ve accumulated $40,000-$50,000 and they don’t have their associate degree yet,” one Florida State College at Jacksonville financial adviser said.

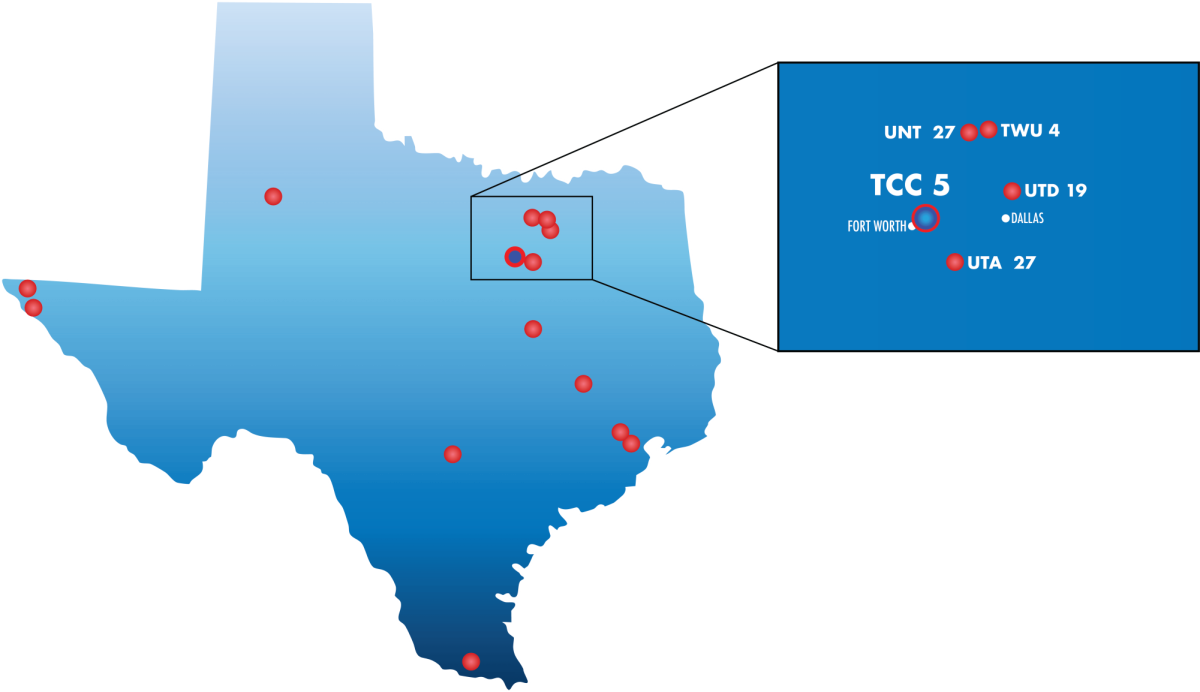

So what can students do to graduate with as little debt as possible? Attending a college that costs less could be one way. Classes at TCC cost $50 per credit hour, compared to $1,800 at TCU or even $369 at UTA. The lower cost gives students a financial break while they complete their core.

Scholarship hunting can net a big result. A Google search for “college scholarships 2011” turned up more than 9 million hits, and many colleges have different scholarships listed on their websites or available at the financial aid office. A couple thousand dollars is way more than minimum wage for the two hours it takes to fill out an application and write an essay.

Another tip for debt reduction is planning ahead. Choosing a major early and sticking with it reduces the likelihood of paying for a class that won’t help a student toward his or her final major.

Researching careers ahead of time never hurts either. Picking majors that can lead to higher salary jobs will allow students to pay their debt off faster. The Georgetown University Center on Education conducted a study called “What’s It Worth? The Economic Value of College Majors.” The research grouped all majors into 15 general groups and compared popularity of the categories and salary statistics. The study found computer and mathematics majors earned the second-highest average salary, but these majors scored ninth in the popularity contest. Yet education, the second most popular major, had one of the lowest average salaries.

Money can be saved in ways besides classes. Getting to the bookstore in time to get used books can save a student 50 to 75 percent or more.

Strategic book return can add up too. Returning a book when there is high demand, and thus a high buy-back price, is a good way to get the most out of last semester’s investment. Right before finals or the week after classes start is a good time to check.

Maybe debt can’t be completely avoided, but it should be a tool to reach a better life, not the anchor that keeps students from that better life.