Viewpoint by Marley Malenfant/se news editor

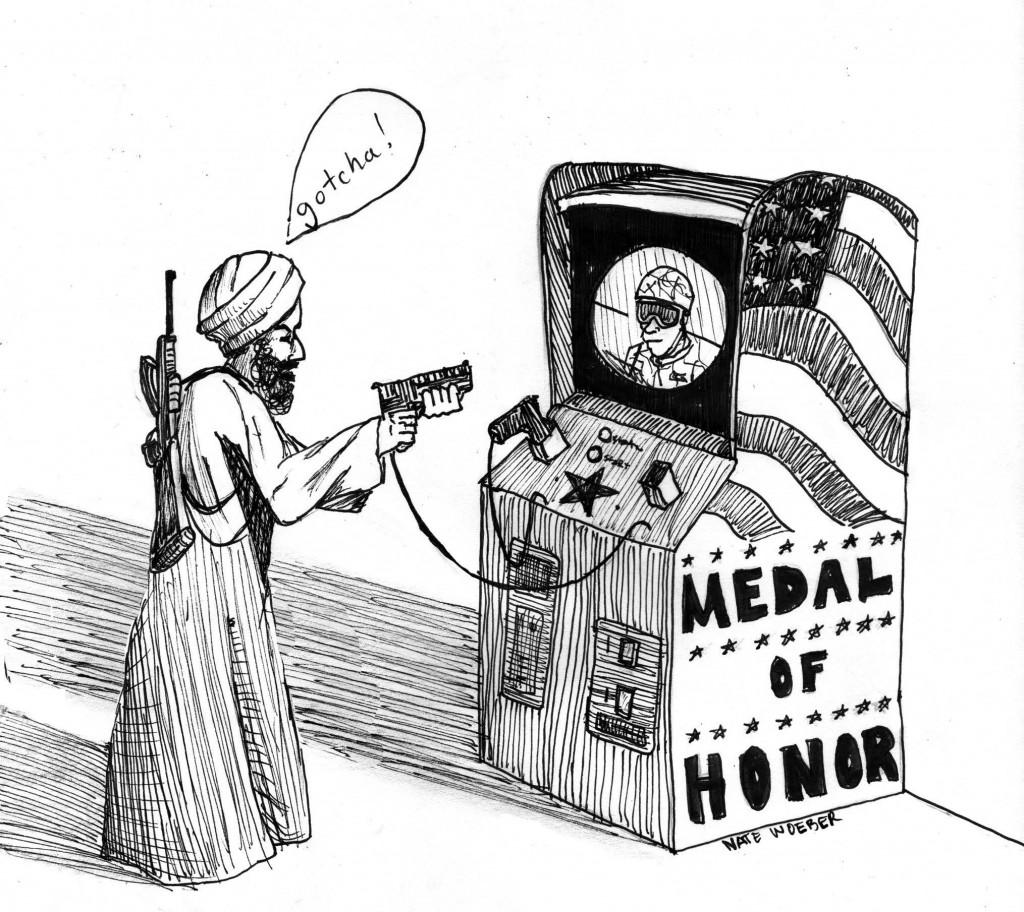

Paper or plastic? Because of the rampant use of debit and credit cards, cash could be less common. According to Credit Cards.com, 41 percent of college students own a debit card.

While some may argue that using a debit card is hassle-free, safer and germ-free, it has opened new doors for financial crimes. While they’re convenient, the cards can also leave a trail for identity thieves.

According to MSN Money, Texas ranks fourth in the U.S. for identity theft. Gone are the days of pocket pickers. Identity theft can simply occur by someone digging through trash looking for receipts, opening someone’s mail with bank account information or finding a lost wallet.

The easiest way to lessen the chances of identity theft is to never carry your Social Security card in a wallet. Also, clean out your wallet. Take out any cards that aren’t needed.

Keeping cash on hand can save money instead of having to pay thousands of dollars on identity theft protection. Using cash for smaller purchases like gas, groceries and entertainment can even help you stay on budget.

Debit cards tend to have a psychological factor. People don’t see the money being spent. It could be splurging on a pair of Air Jordan 11 retros or some purse that runs for $200.

Buying items like these on a debit card can hurt your pockets later with overdraft fees if you’re not keeping up with your transactions.

Purchasing items with a credit card should be avoided if possible. According to Forbes magazine, people who use credit cards spend 18 percent more than those who buy with cash.

Get in the habit of using cash. The fewer credit card accounts open, the better. Using cash keeps away the madness of due dates, unexpected fees, useless rewards and interest.

Using cash and debit cards is all about balance. Know when it’s time to use cash and when it’s time to pull out the plastic.

Let’s keep the world a greener place. Use cash.