By Shelly Williams/editor-in-chief

President Barack Obama has called on Congress to make something called the American Opportunity Tax Credit permanent.

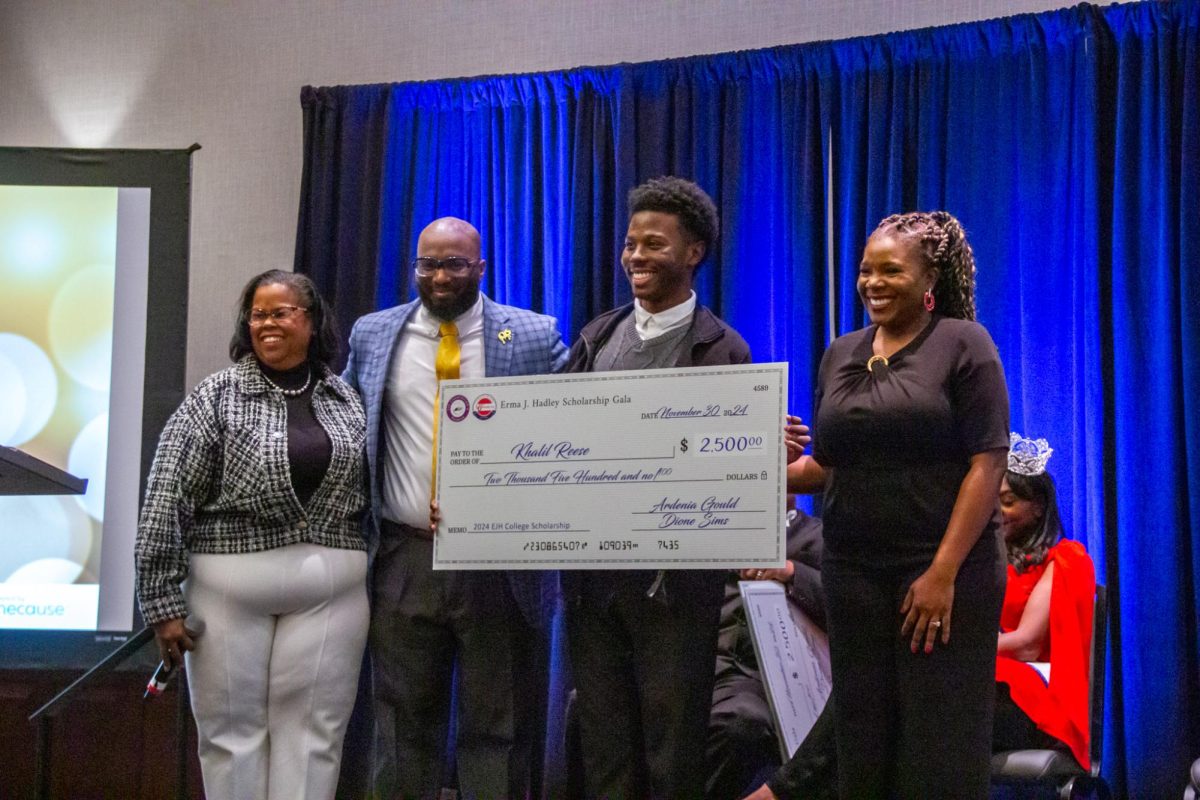

The proposal, part of the 2009 stimulus package, provides a tax credit up to $2,500. In addition, it covers tuition, fees, textbooks and other course materials for four years of college.

Unfortunately, it’s about to expire at the end of this year.

Obama said he’d like to extend this to allow the credit to be worth up to $10,000 for each student, according to an article by The Christian Science Monitor.

“We’ve got to make sure that in good times or bad, our families can invest in their children’s future and in the future of our country,” he said.

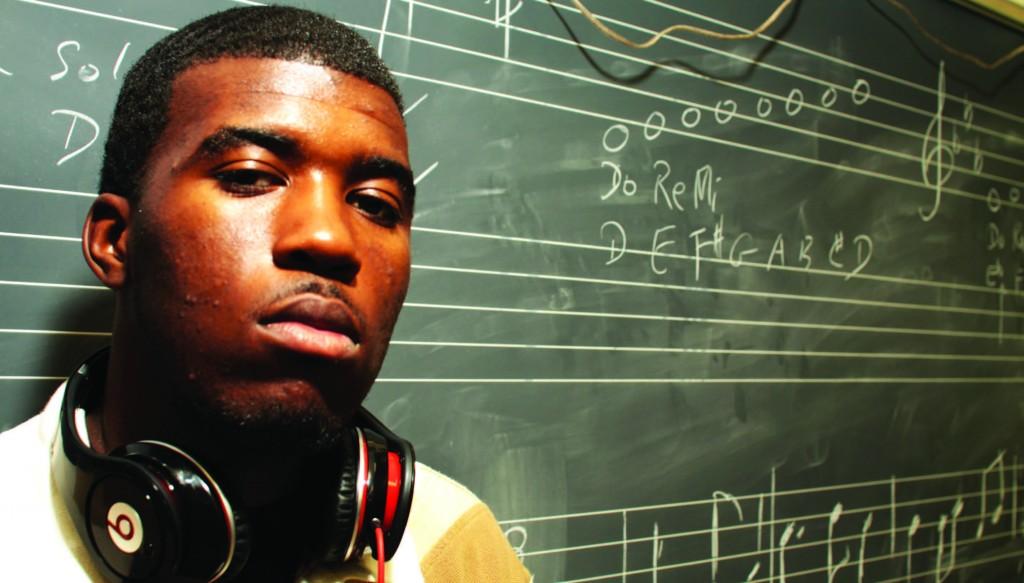

The future of our country rests in the hands of those who come after us, but it also rests in the hands of those making decisions now.

And right now, because of our decisions, the economy isn’t looking too hot. If this credit is extended, and it’s being paid by stimulus money (remember, that money supposedly runs out this year), who will pay for its extension?

According to the Treasury Department, the tax credit is just as valuable for students who attended community college as a more affordable option for their first two years of college, said the Diverse: Issues in Higher Education website.

The report said that graduates of both four-year and community colleges earn significantly higher wages. In 2009, the average college graduate earned 63 percent more than the average high school graduate, the website reported.

The tax credit would help many people who need extra financial help get a higher education. Expanding the current tax credit would be a wonderful way to help because of the way tuition rates are and the impact the economy has had on prospective college students who are struggling.

Education is key when it comes to going further in life, but college is hard enough to pay for as is. The money has to come from somewhere, and if it comes from raising the tax rate in some form, then prospective college students already struggling to pay for college will only continue to fight an uphill battle that much more.

True, the nation is supposed to be cutting back on spending, but members of Congress should take a look at the tax credit program again and make sure that this good investment isn’t passed up.