VIEWPOINT

The US tax system can be intimidating for many. It is not common to be taught how to file taxes and it is something most people figure out on their own. Simplifying taxes would make it easier for people to comply with them and understand how they work.

Tax legislation in the US is convoluted and makes filing taxes burdensome. This can make taxpayers who do not understand the rules feel isolated and untrustworthy of the system.

Due to the unnecessary complexity of these laws, it makes filing taxes a time consuming and expensive process. Those who cannot afford professional tax advice get the short end of the stick.

To create a more straight forward system would lead to a smoother experience and more compliance for taxpayers.

Companies like TurboTax have taken advantage of the mystery surrounding tax laws in the past. Taxpayers under a certain income level can file their taxes for free. Through misleading adverts TurboTax made it very difficult to reach the part of their site that allowed for this. This trapped qualifying taxpayers to pay for their services.

Many taxpayers make mistakes when filing taxes due to the long list of rules in the US tax code that are not common knowledge. Yet, every year the Tax Code gets more and more complex.

There are over 800 IRS tax forms. They can be connected and leave a confusing paper trail to follow. Figuring them out without professional help is daunting and difficult and leaves taxpayers no choice but to spend money.

If tax laws were more focused on being easily understood it would create more trust in the system as well as save taxpayers a significant amount of time and money.

The National Taxpayer Advocate says that using uniform definitions in the tax code is one recommendation to achieve this. The increased accessibility will create the base for taxpayers to be more confident in their ability to file taxes.

Maximizing your tax refund is also made difficult if you do not understand how tax laws work. This leads to the system favoring taxpayers that can afford to get help and leaving those who cannot at a disadvantage.

A big reason people don’t comply with filing their taxes is because they do not understand how it works. The IRS should take steps to make the process smoother and geared towards the taxpayers instead of policy interests.

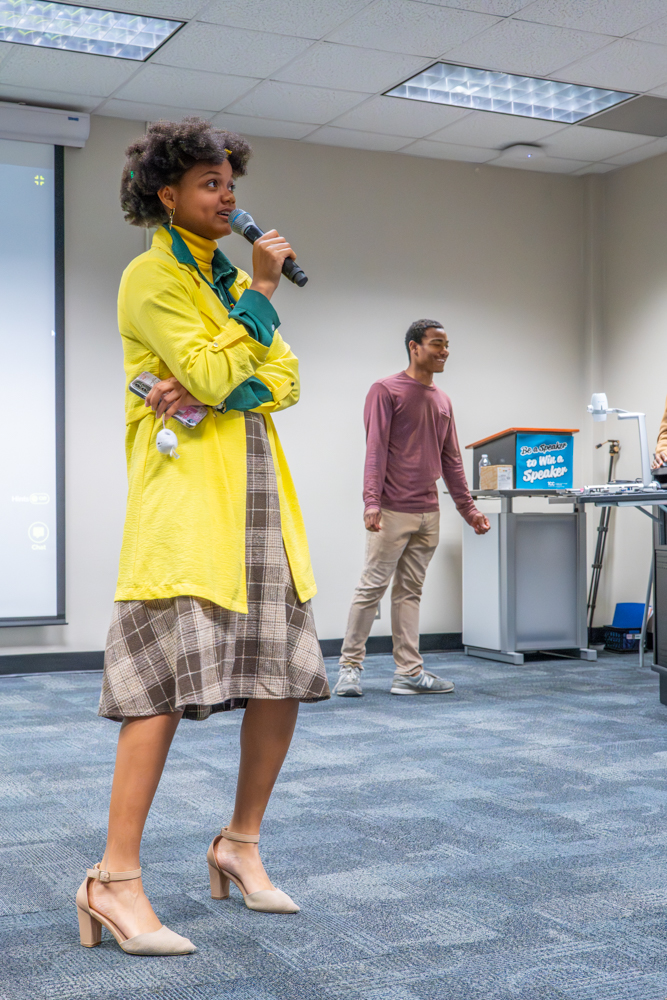

Implementing education that would explain the process of filing taxes may also make the process less overwhelming to those filing for the first time.

As taxes are required for most people, spending time going over how they work is practical and useful. Being prepared for them may help in making them less confusing.

There are groups that advocate for taxpayers and the simplification of the Tax Code to make the process less burdensome. Groups like The National Taxpayer Advocate are working to create an easy to understand tax process in the US.

Paying your taxes can be daunting but there are resources online to provide some clarity. There is a widespread understanding of the complexity of US tax legislation and many articles go into breaking it down to make it more accessible.

Moving forward, there needs to be changes made to the tax system so that taxpayers can have more trust in the system as well as be able to save their time, as well as their money.