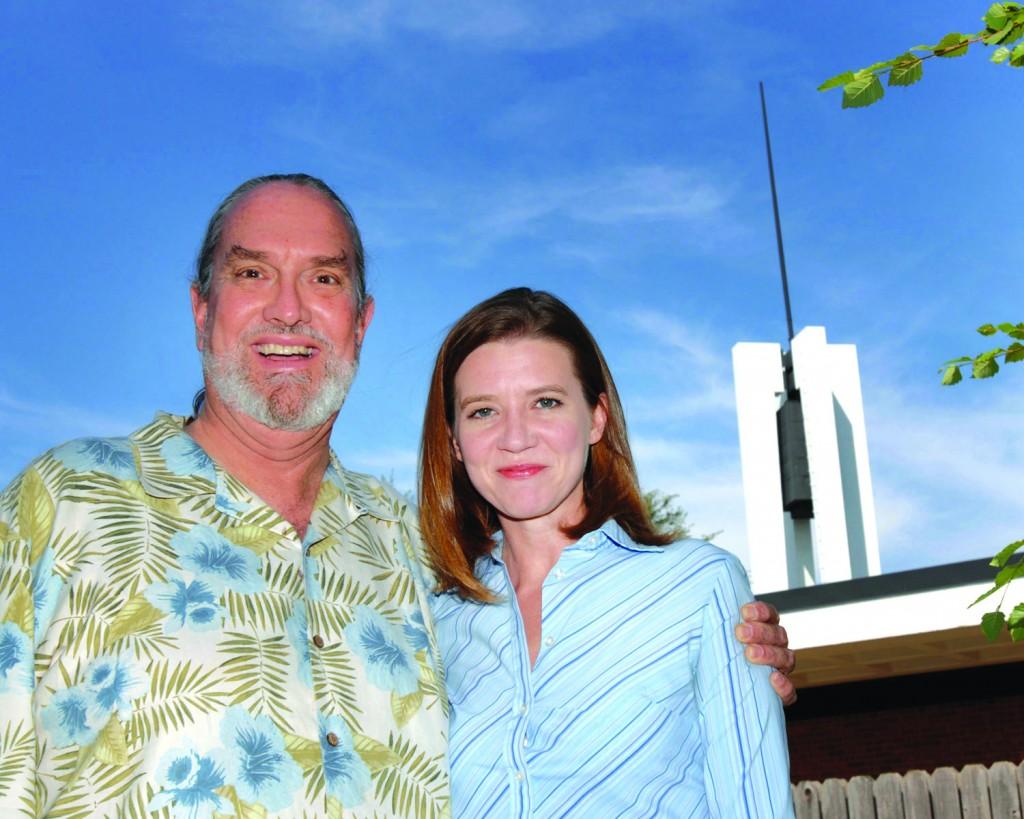

By Ciara Anderson/reporter

Borrowing money is a serious matter, a financial aid associate told NE students April 29.

Imelda Ramos started Before You Leave: Exit Counseling for Student Borrowers by explaining the responsibilities students agree to when they sign the Master Promissory Note to get their student loans.

The MPN is a written promise that students will pay back the money borrowed for school expenses.

“When you fail to make payments, a negative report could be placed on your credit report and that could result in you not getting a job,” she said.

The loan defaults placed on a credit score won’t default for seven years, Ramos added as she detailed consequences of not paying back student loans and ignoring the federal student loan servicer.

“A percent of your wages may be withheld by your employer and sent toward your defaulted loan,” she said. “If you don’t pay back your student loans, you could possibly be sued.”

Ramos offered different tips for managing student debt.

“After graduation, you will have six months to repay loans without interest depending on if you get a subsidized loan or an unsubsidized loan,” she said.

A subsidized loan doesn’t create interest until after six months. Ramos introduced payment plans that will help the repayment of student loans not be so stressful. She said most of the payment plans are based off one’s annual gross income and family size.

“If you are ever experiencing financial hardship, don’t ignore your servicer,” she said. “Talk to your servicer about a different payment plan.”

Ramos cautioned students to read and pay attention to what they are signing.

“When taking out a loan and signing the MPN, you need to be ready and fully aware of all the responsibilities,” she said.