By Liliana Green/ reporter

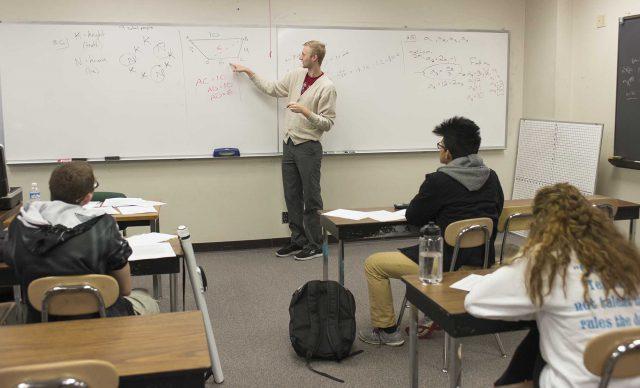

Preparing to fulfill a student loan commitment includes learning about loan responsibilities, a financial aid specialist told NE students Feb. 9.

The Plan for Success workshop provided students with information about federal student loan obligations and with critical lessons that can affect successful repayment of those loans.

Joe Rodriguez said students use student loans to supplement their income, if any, and to help with their expenses such as food, housing and transportation. However, it is vital to track loans even while in school.

“The choices you make will affect your budget later,” he said. “Borrowing for your education can greatly impact your quality of life today and after you graduate.”

For 12 years, Rodriguez has been helping college students with financial aid gain a better understanding about student-loan borrowing and responsibility. He understands that unforeseen situations cannot be avoided, but students can be prepared.

Although a student loan may be easy to obtain, it won’t be easy to get rid of if it is not paid back, Rodriguez said. Some consequences can negatively impact a student’s life if the student loan goes into default.

Employers often check credit scores before making job offers. Bad credit scores can prevent someone from getting a job, which means no income to pay bills, Rodriguez said. Failing a credit check will keep someone from buying a car, a house or renting an apartment.

One student said she was shocked to learn one of the big consequences of not paying the student loan is the ineligibility for additional federal financial aid if she decided to go back to school for another degree. Rodriguez said a student may not be able to attend school at all if they go into default status.

Students are getting student loans without truly knowing the responsibilities that come with a student loan nor the consequences that may arise, Rodriguez said.

In the workshop, Rodriguez explained the meaning of getting a federal student loan and the different types of repayment plans.

Currently, eight different student loans are available. Some repayment plans are based on the loan balance, others are focused on the monthly payment, and a couple are income-based. Attendees received a training module that included an FAQ section, detailing accrued interest on the student loan as well as the consequences of not meeting the student loan obligations.

Certain academic decisions can affect repayment of student loans, so students should consult with a financial aid counselor before dropping any classes, changing a graduation date or withdrawing from or transferring to schools, Rodriguez said.

“My best advice is if you don’t need it, don’t get it,” he said.

Students can visit the Federal Student Aid website at www.studentloans.gov and the National Student Loan Data System website www.nsdls.ed.gov for more information.