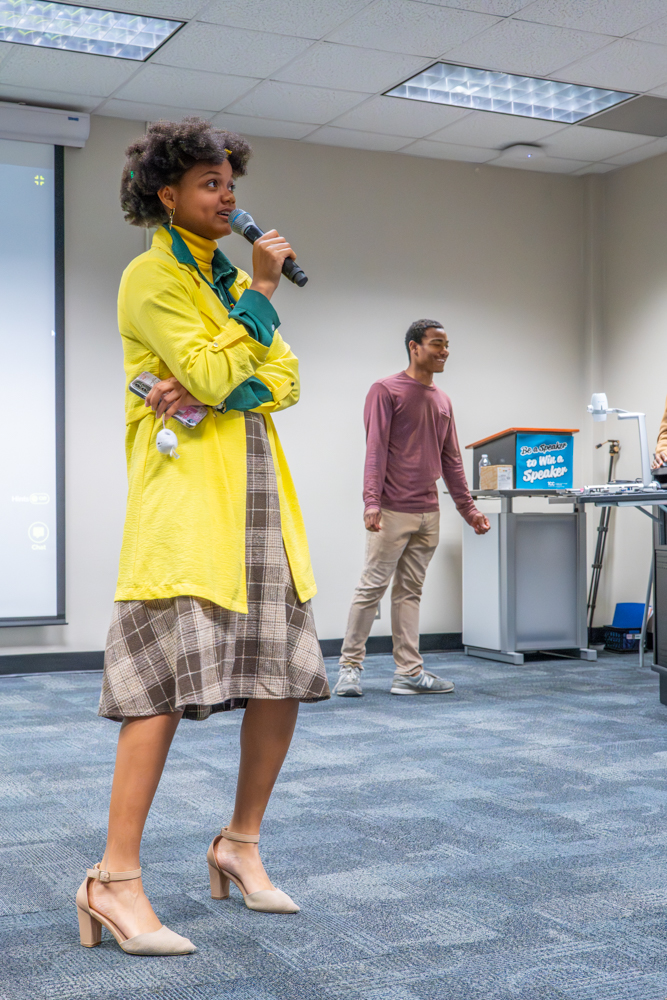

Kyle Ellis

reporter

The Texas tax deadline was extended to June 15 because of the winter storm that crippled the state. As college students prepare to file, it is important to know how to get the most cash back.

There is more to tax season than just filing. Renee Brooks, CEO of Brooks Books Accounting and Bookkeeping in Southlake, recommends preparing taxes all year long and keeping receipts.

Many school expenses are deductible, including tuition and fees, textbooks and supplies. Students should take advantage of tax deductions, NW accounting adjunct instructor Christopher Mitchell said.

“The tuition and fees deduction allows eligible taxpayers to deduct up to $4,000 in qualified higher education expenses for themselves, a spouse and dependent children as an above-the-line exclusion from income,” Mitchell said.

Scholarships that have been applied to a school account may be taxable too.

Every student should take advantage of two credits, the American Opportunity Credit and the Lifetime Learning Credit, Mitchell said.

“This can save them thousands of dollars,” he said.

Robert Gill, a Certified Public Accountant from Grapevine, said when possible, parents should claim students as dependents so more deductions are available to them. Mitchell agreed that understanding dependency status can greatly impact potential refunds.

Students can deduct student loan interest and file state tax returns in other states if they work or pay tuition to a school outside of Texas. For example, if a student is a Texas resident but goes to school and works in Arkansas, the student will need to file an Arkansas state return in addition to their normal federal tax return.

Gill said students should also know their employment status. If they get a W-2, then taxes have already been withdrawn. However, if the student does contract work for a set payment, taxes will have to be paid.

“This is why keeping those receipts is important,” he said.