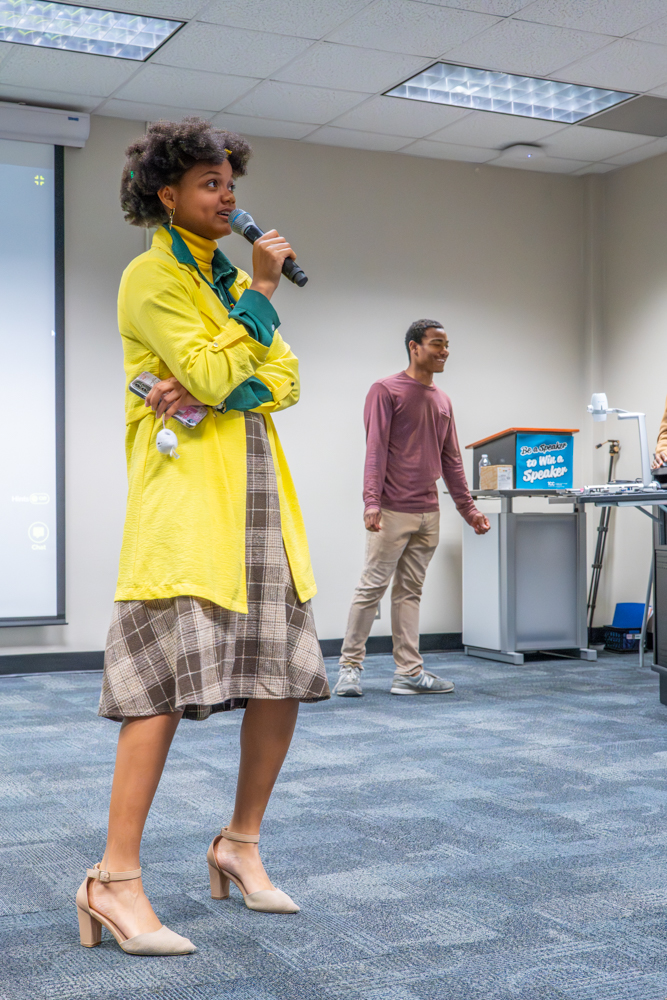

The first step to financial independence is mindset, said Cathy Trinh, a business instructor for Connect Campus.

Trinh migrated to the U.S. from Vietnam with $300 in her pocket and was able to transform her circumstances into success by becoming a millionaire.

In her online webinar Sept. 9, she offered advice to the TCC community and participants on how to grow their own income and achieve financial freedom, no matter the stage a person may be in.

“I want you to know that financial freedom isn’t about profession,” she said in the webinar. “It’s about progress. And if I can build a life from [my] beginnings, you can build your life too.”

Changing a mindset to being more open to financial opportunities means expanding on what a person values in life.

She recommend writing down personal goals and creating vision boards that reflect what you want in life.

“I work with people — either a student who barely has anything or even multi-millionaire — and it’s amazing to see how the negative mindset really, really affects people,” she said.

Her second piece of advice is to implement the 50/30/20 budgeting rule, a financial strategy coined by Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan.”

The rule explains that 50% of your income should go into personal needs like food, housing and transportation. 30% should be dedicated to “wants,” like entertainment and takeout, while the other 20% goes to personal life savings.

“When you know where your money is going, you are in control,” Trinh said.

She also recommended utilizing technology to your advantage and finding ways to track finances using online resources.

John Peninger, an accounting instructor at Connect, was also among the viewers at the webinar.

He agreed that trustworthy apps are a great way to track finances. He personally recommended the app Rocket Money.

Another piece of advice Trinh gave was paying off debt through the snowball or avalanche method.

The snowball method means paying off the smallest debt that has collected and working up to the largest. The avalanche method is the opposite, targetting the largest debt. Trinh warned that doing these methods means keeping consistent every time.

“Never make a late payment, always the minimum payment,” she said. “And then after you have addressed that you want to keep your credit use less than 30% of your limit.”

Finally, she explained that focusing on your future and ensuring a retirement plan is being worked towards will make the difference when the time comes.

Trinh explained that while traditional retirement accounts offered by companies and the IRA’s work, that is not the only kind to exist out there. She mentioned real estate being one example of non-traditional retirement.

“I’m sharing all of this just so that you understand where I used to be, all the horrible mistakes I made,” she said. “I’m here to tell you that even if you make mistakes, you can still come out ahead.”